I’m backing the campaign calling on the Labour Government’s to reverse its decision to abandon farmers by announcing changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) – essentially introducing a Family farm Tax.

A total of 512 farm holdings in Bexhill & Battle are now at risk!

In a world with tightened margins, record inflation, extreme weather and increased production costs, many farmers are already struggling to ensure that they are financially viable for the next year. What farmers need most is a government who understands this and reflects it in their budget. Sadly, this is not the case.

It is astonishing that the Minister admitted he had only read about the impact altering APR & BPR would have the weekend after the decision was announced!

Under the last Government, the £2.4 billion farming budget was maintained annually. Any underspend was rolled forward, and the average value of farming payment schemes was increased by 10 per cent. Furthermore, the previous Government launched the biggest package of grants worth £427 million for farm businesses, supporting productivity and innovation.

Indeed, Ministers in the last Government prioritised food security and set a commitment to grow 60 per cent of our food at home. It is true to say that we didn’t get everything right when it came to spending that money and making sure it was getting to farmers and helping them grow our food but we always maintained the protections for farms that ensure they can be passed on between the generations.

I am concerned about the lack of vision or ambition for the sector, as evidenced by the scarce 87 words included in the Labour manifesto on farming.

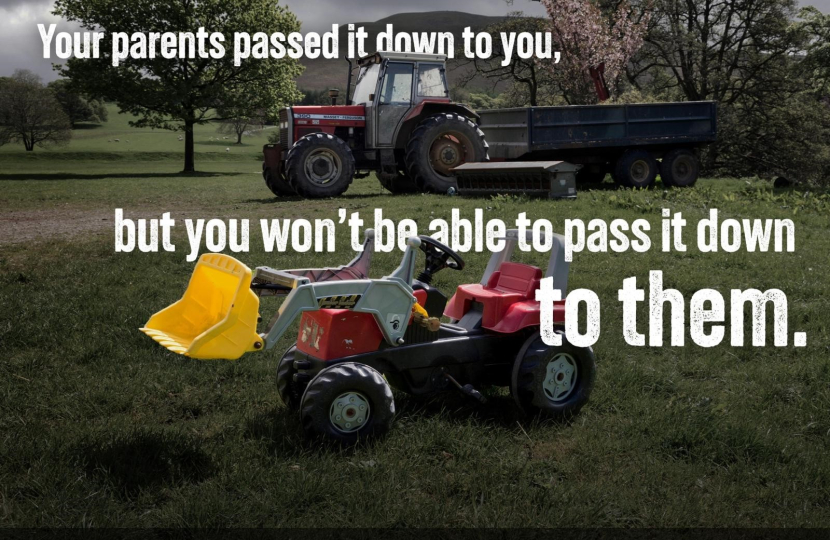

The Family Farm Tax will hit local family farmers hard, making it almost impossible for many ordinary farmers to pass on their holdings, some of which will have been in the family for decades.

I know most people are very proud of the fact that we have families that have farmed our land for generations and I know it is sometimes difficult to persuade the next generation to do so. This will make it even harder and for many farms will simply mean the numbers don’t add up.

If you have not already, I recommend doing so to ensure your voice of opposition is heard amongst the thousands of others by signing the campaign:

https://www.whatlaboursaid.com/stop-the-family-farm-tax

I also raised it in Parliament when I had the opportunity to ask the Defra Minister of State whether the Government would be rethinking their decision on family farm tax – you can watch the clip here.

Whilst the Minister claimed that the NFU had praised the Government on keeping to our spending plans he was omitting what the NFU have said about this tax.

I plan to attend the protest in London later in the month where I'm due to meet a number of other local farmers as we continue this campaign.